Startup Benchmarks vs. BondSmartly

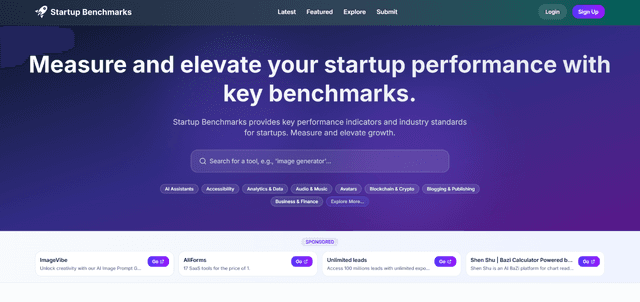

Startup Benchmarks

Startup Benchmarks is a centralized platform offering key performance indicators (KPIs) and industry benchmarks tailored for startups. Whether you're a founder, operator, or investor, gain instant access to data-driven insights that help you measure, compare, and improve your company’s growth. Explore metrics like CAC, LTV, MRR, retention, and more—across multiple industries and stages. With curated tools, featured AI products, and startup-friendly resources, Startup Benchmarks bridges the gap between ambition and execution through real data.

BondSmartly

BondSmartly.com is a platform designed to streamline bond investment decisions by offering access to yield curves of over 500,000 bonds. It provides users with comprehensive search filters, allowing them to discover using a powerful bonds screener based on various parameters such as ISIN, issuer, coupon rate, and maturity date. Investors can utilize the yield curve data to analyze different bonds and make informed choices. Additionally, the platform features tools like a YTM (Yield to Maturity) calculator and bond screener, making it an all-in-one resource for bond market insights and analytics. With these features, BondSmartly helps investors optimize their portfolios with precision and ease.

Reviews

Reviews

| Item | Votes | Upvote |

|---|---|---|

| No pros yet, would you like to add one? | ||

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

| Item | Votes | Upvote |

|---|---|---|

| Prices for over 500.000 bonds | 1 | |

| Bonds screener | 1 | |

| Reference data for bonds of all types | 1 | |

| Yield curves for all bonds by one issuer. | 1 |

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

Frequently Asked Questions

Startup Benchmarks focuses on providing key performance indicators and industry benchmarks specifically for startups, helping founders and investors measure and improve growth metrics like CAC and LTV. In contrast, BondSmartly is tailored for bond investors, offering access to yield curves and a comprehensive bond screener for over 500,000 bonds. If you're looking for insights into startup performance, Startup Benchmarks is the better choice, while BondSmartly is ideal for those focused on bond investment decisions.

BondSmartly provides a range of tools specifically designed for bond analysis, including a yield to maturity calculator and a powerful bonds screener that allows users to filter bonds based on various parameters. Startup Benchmarks, while offering valuable insights for startups, does not provide the same level of detailed financial analysis tools for bond investments. Therefore, for comprehensive financial analysis related to bonds, BondSmartly is the superior platform.

BondSmartly is specifically designed to help bond investors optimize their portfolios with access to extensive bond data and analytical tools. It allows users to analyze yield curves and make informed investment decisions. Startup Benchmarks, on the other hand, is more focused on providing performance metrics for startups rather than portfolio optimization for bond investments. Therefore, for investors looking to optimize their bond portfolios, BondSmartly is the more suitable choice.

Startup Benchmarks is a centralized platform that provides key performance indicators (KPIs) and industry benchmarks specifically designed for startups. It offers data-driven insights that help founders, operators, and investors measure, compare, and enhance their company's growth.

On Startup Benchmarks, you can explore various metrics such as Customer Acquisition Cost (CAC), Lifetime Value (LTV), Monthly Recurring Revenue (MRR), retention rates, and more. These metrics are available across multiple industries and stages of startup development.

Startup Benchmarks is beneficial for founders, operators, and investors who are looking for data-driven insights to measure and improve their startup's performance. It serves as a valuable resource for anyone involved in the startup ecosystem.

Startup Benchmarks offers curated tools, featured AI products, and startup-friendly resources that help bridge the gap between ambition and execution through real data. These resources are designed to support startups in their growth journey.

BondSmartly.com is a platform designed to streamline bond investment decisions by offering access to yield curves of over 500,000 bonds. It provides users with comprehensive search filters, allowing them to discover using a powerful bonds screener based on various parameters such as ISIN, issuer, coupon rate, and maturity date. Investors can utilize the yield curve data to analyze different bonds and make informed choices. Additionally, the platform features tools like a YTM (Yield to Maturity) calculator and bond screener, making it an all-in-one resource for bond market insights and analytics.

Pros of BondSmartly include prices for over 500,000 bonds, a powerful bonds screener, reference data for bonds of all types, and yield curves for all bonds by one issuer. There are no user-generated cons at this time.

BondSmartly offers several features including a powerful bonds screener based on parameters such as ISIN, issuer, coupon rate, and maturity date. It also provides yield curves for over 500,000 bonds, reference data for bonds of all types, and tools like a YTM (Yield to Maturity) calculator.

BondSmartly helps investors by providing comprehensive tools and data to make informed bond investment decisions. Users can access yield curves for over 500,000 bonds, use a powerful bonds screener to filter based on various parameters, and utilize tools like the YTM calculator to analyze different bonds. This enables investors to optimize their portfolios with precision and ease.