Competitor Research vs. QuickData.ai

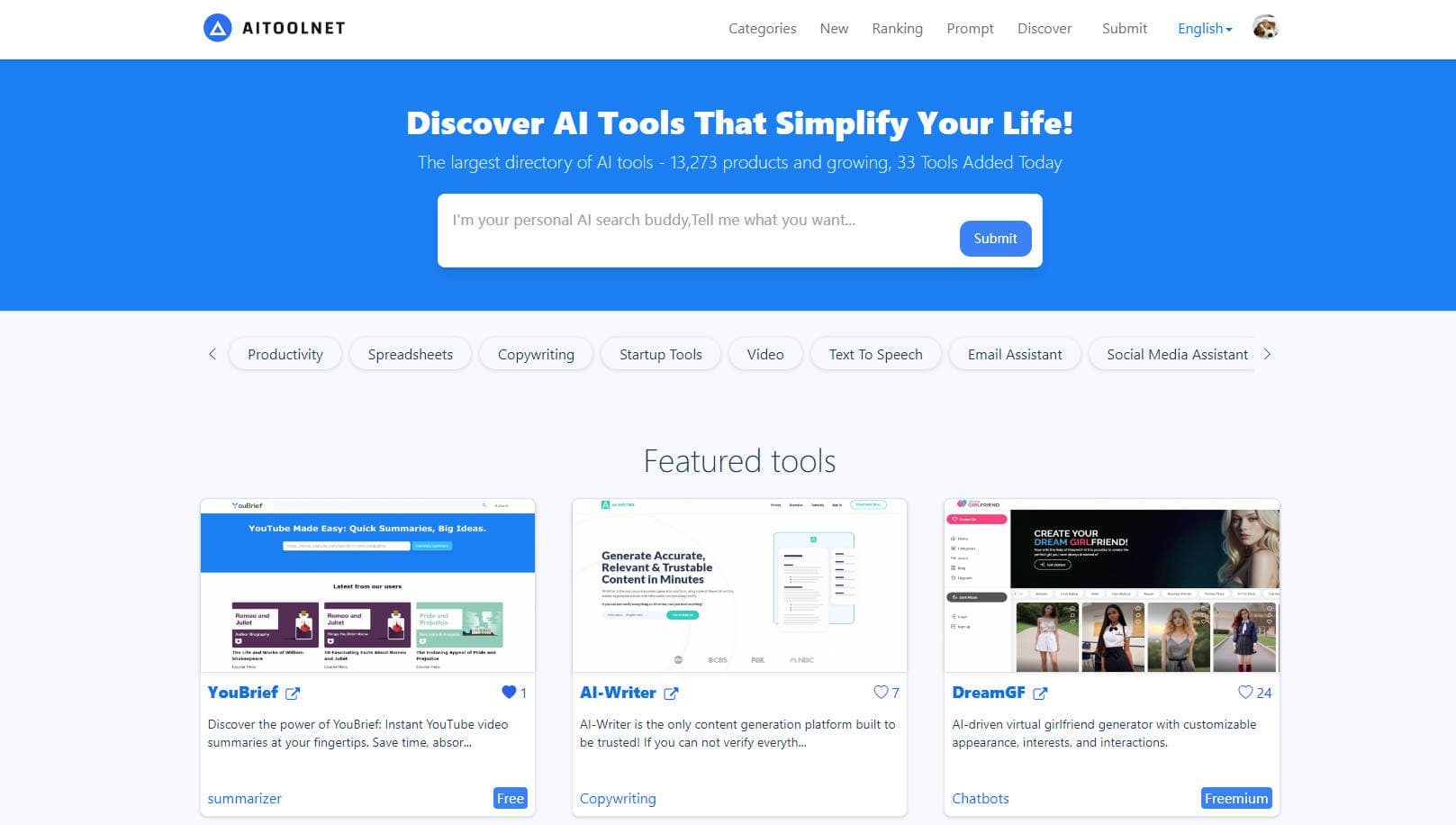

Competitor Research

AI tool to help companies track their competitors

QuickData.ai

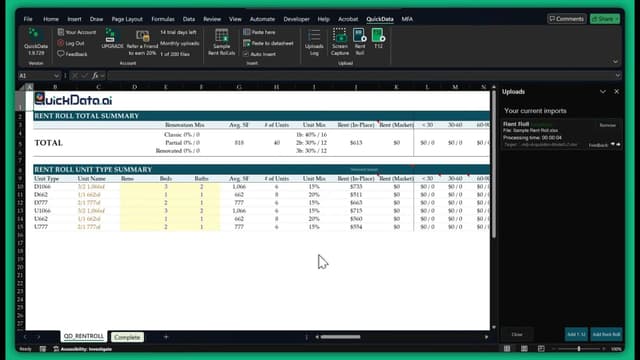

QuickData.ai: Excel Add-In for Automated Multifamily Real Estate Data Extraction QuickData.ai extracts data from rent rolls, T12 statements, and offering memorandums directly into Excel underwriting models. This AI for multifamily real estate eliminates manual data entry for acquisitions teams, brokers, and lenders. Features: Automated rent roll parsing, T12 parsing, Excel integration, unit-level data extraction, one-click processing. Benefits: Saves 15 hours monthly, analyzes deals in minutes, eliminates manual errors, handles increased volume. Target Users: Acquisitions teams, commercial real estate brokers, lenders, accounting firms. Use Cases: Multifamily real estate underwriting, AI in commercial real estate. Technical: Excel add-in, PC compatible, processes PDF and Excel formats, works with existing models in Excel. QuickData.ai automates manual tasks using AI for commercial real estate professionals.

Reviews

Reviews

| Item | Votes | Upvote |

|---|---|---|

| No pros yet, would you like to add one? | ||

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

| Item | Votes | Upvote |

|---|---|---|

| No pros yet, would you like to add one? | ||

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

Frequently Asked Questions

Competitor Research is primarily focused on tracking competitors, making it less suitable for data extraction tasks. In contrast, QuickData.ai is specifically designed for automated data extraction in the multifamily real estate sector, offering features like automated rent roll parsing and Excel integration. Therefore, for data extraction tasks, QuickData.ai is the more effective choice.

QuickData.ai is tailored for real estate professionals, providing automated data extraction from rent rolls and financial statements, which is essential for underwriting in multifamily real estate. Competitor Research, while useful for tracking competitors, does not cater specifically to the needs of real estate professionals. Thus, QuickData.ai is the better option for those in the real estate industry.

Yes, Competitor Research and QuickData.ai can be used together effectively. Competitor Research can provide insights into market competition, while QuickData.ai can streamline data extraction and analysis for real estate transactions. Using both tools can enhance strategic decision-making in the real estate sector.

Competitor Research is an AI tool designed to help companies track their competitors. It offers insights into competitor strategies, strengths, and weaknesses to help businesses stay ahead in their industry.

The main features of Competitor Research include real-time tracking of competitor activities, detailed analysis of competitor strengths and weaknesses, and actionable insights to optimize your business strategies. The tool utilizes advanced AI algorithms to provide accurate and up-to-date information.

Competitor Research can benefit a wide range of industries including technology, retail, finance, healthcare, and more. Any business that wants to gain a competitive edge by understanding their competitors' strategies can find this tool useful.

Competitor Research helps in business strategy by providing detailed insights into the activities of competitors. This information can be used to identify market trends, anticipate competitor moves, and make informed decisions to improve your own business strategies.

Yes, Competitor Research is designed to be user-friendly with an intuitive interface. It provides clear and concise reports that are easy to understand, even for users who may not have extensive experience with AI tools.

QuickData.ai is an Excel add-in designed for automated multifamily real estate data extraction. It allows users to extract data from rent rolls, T12 statements, and offering memorandums directly into Excel underwriting models, significantly reducing the need for manual data entry.

The main features of QuickData.ai include automated rent roll parsing, T12 parsing, Excel integration, unit-level data extraction, and one-click processing. These features streamline the data extraction process for real estate professionals.

Using QuickData.ai can save users approximately 15 hours monthly, allow for deal analysis in minutes, eliminate manual errors, and handle increased data volume efficiently. This makes it a valuable tool for acquisitions teams, brokers, and lenders in the multifamily real estate sector.

The target users of QuickData.ai include acquisitions teams, commercial real estate brokers, lenders, and accounting firms. It is particularly beneficial for professionals involved in multifamily real estate underwriting.

QuickData.ai is an Excel add-in that is compatible with PCs. It processes data from PDF and Excel formats and works seamlessly with existing models in Excel, making it easy to integrate into current workflows.

QuickData.ai supports use cases in multifamily real estate underwriting and the application of AI in commercial real estate. It automates manual tasks, enhancing efficiency for real estate professionals.