AI Watermark Remover Online for Free vs. BondSmartly

AI Watermark Remover Online for Free

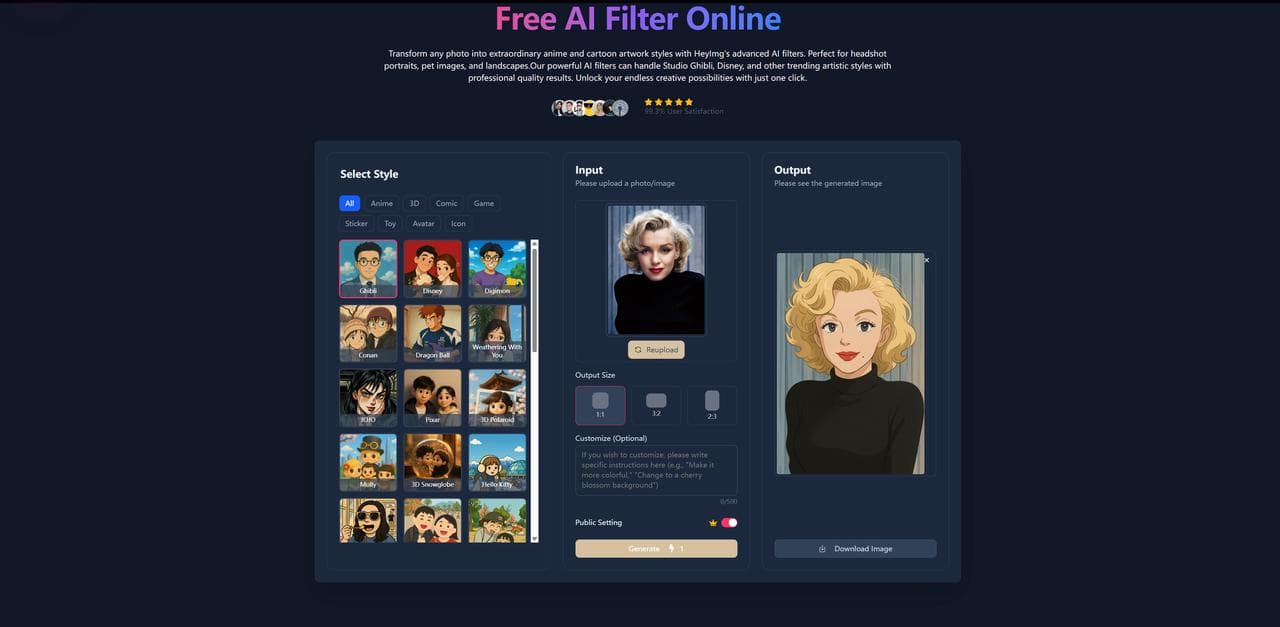

AI Watermark Remover is a powerful AI tool designed for effortlessly removing watermarks from images and videos in no time, with no need for Photoshop skills. It's especially ideal for creators and professionals who work with images. With its user-friendly interface, AI Watermark Remover simplifies the process, allowing for the seamless removal of not only watermarks but also other unwanted elements such as logos and text overlays. The technology behind this tool uses advanced algorithms to detect and erase watermarks without compromising the original quality of the image or video. This precision ensures that the aesthetics of the visuals are maintained, making this tool ideal for professionals aiming to produce clean and unblemished media for presentations, marketing materials, and online content. Furthermore, the speed of AI Watermark Remover is a significant advantage, providing quick results that help maintain a fluid workflow and boost productivity.

BondSmartly

BondSmartly.com is a platform designed to streamline bond investment decisions by offering access to yield curves of over 500,000 bonds. It provides users with comprehensive search filters, allowing them to discover using a powerful bonds screener based on various parameters such as ISIN, issuer, coupon rate, and maturity date. Investors can utilize the yield curve data to analyze different bonds and make informed choices. Additionally, the platform features tools like a YTM (Yield to Maturity) calculator and bond screener, making it an all-in-one resource for bond market insights and analytics. With these features, BondSmartly helps investors optimize their portfolios with precision and ease.

Reviews

Reviews

| Item | Votes | Upvote |

|---|---|---|

| No pros yet, would you like to add one? | ||

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

| Item | Votes | Upvote |

|---|---|---|

| Prices for over 500.000 bonds | 1 | |

| Bonds screener | 1 | |

| Reference data for bonds of all types | 1 | |

| Yield curves for all bonds by one issuer. | 1 |

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

Frequently Asked Questions

AI Watermark Remover is better suited for creative professionals who work with images and videos, as it provides a powerful tool for removing watermarks and other unwanted elements without compromising quality. On the other hand, BondSmartly is a specialized platform for investors looking to make informed bond investment decisions by offering comprehensive bond market insights and analytics. Therefore, AI Watermark Remover is more beneficial for creative professionals, while BondSmartly is ideal for investors.

BondSmartly is more useful for investment decisions as it provides access to yield curves of over 500,000 bonds, comprehensive search filters, and tools like a YTM calculator and bond screener. This makes it an all-in-one resource for bond market insights and analytics, helping investors make informed choices. AI Watermark Remover, on the other hand, is focused on removing watermarks from images and videos, which is not relevant to investment decisions.

AI Watermark Remover Online for Free is a powerful AI tool designed for effortlessly removing watermarks from images and videos. It offers a user-friendly interface that simplifies the process, making it ideal for creators and professionals who work with images.

The main features of AI Watermark Remover Online for Free include the ability to remove watermarks, logos, and text overlays from images and videos without compromising the original quality. It uses advanced algorithms to ensure precision and maintains the aesthetics of the visuals. Additionally, it provides quick results, which help maintain a fluid workflow and boost productivity.

AI Watermark Remover Online for Free is particularly beneficial for creators and professionals who work with images and videos. It is ideal for those who need to produce clean and unblemished media for presentations, marketing materials, and online content.

Currently, there are no user-generated pros and cons for AI Watermark Remover Online for Free.

AI Watermark Remover Online for Free uses advanced algorithms to detect and erase watermarks without compromising the original quality of the image or video. This ensures that the aesthetics of the visuals are maintained.

BondSmartly.com is a platform designed to streamline bond investment decisions by offering access to yield curves of over 500,000 bonds. It provides users with comprehensive search filters, allowing them to discover using a powerful bonds screener based on various parameters such as ISIN, issuer, coupon rate, and maturity date. Investors can utilize the yield curve data to analyze different bonds and make informed choices. Additionally, the platform features tools like a YTM (Yield to Maturity) calculator and bond screener, making it an all-in-one resource for bond market insights and analytics.

Pros of BondSmartly include prices for over 500,000 bonds, a powerful bonds screener, reference data for bonds of all types, and yield curves for all bonds by one issuer. There are no user-generated cons at this time.

BondSmartly offers several features including a powerful bonds screener based on parameters such as ISIN, issuer, coupon rate, and maturity date. It also provides yield curves for over 500,000 bonds, reference data for bonds of all types, and tools like a YTM (Yield to Maturity) calculator.

BondSmartly helps investors by providing comprehensive tools and data to make informed bond investment decisions. Users can access yield curves for over 500,000 bonds, use a powerful bonds screener to filter based on various parameters, and utilize tools like the YTM calculator to analyze different bonds. This enables investors to optimize their portfolios with precision and ease.