Dynamiq vs. BondSmartly

Dynamiq

Dynamiq the operating platform for building, deploying, monitoring and fine-tuning generative AI applications. Key features: 🛠️ Workflows: Build GenAI workflows in a low-code interface to automate tasks at scale 🧠 Knowledge & RAG: Create custom RAG knowledge bases and deploy vector DBs in minutes 🤖 Agents Ops: Create custom LLM agents to solve complex task and connect them to your internal APIs 📈 Observability: Log all interactions, use large-scale LLM quality evaluations 🦺 Guardrails: Precise and reliable LLM outputs with pre-built validators, detection of sensitive content, and data leak prevention 📻 Fine-tuning: Fine-tune proprietary LLM models to make them your own

BondSmartly

BondSmartly.com is a platform designed to streamline bond investment decisions by offering access to yield curves of over 500,000 bonds. It provides users with comprehensive search filters, allowing them to discover using a powerful bonds screener based on various parameters such as ISIN, issuer, coupon rate, and maturity date. Investors can utilize the yield curve data to analyze different bonds and make informed choices. Additionally, the platform features tools like a YTM (Yield to Maturity) calculator and bond screener, making it an all-in-one resource for bond market insights and analytics. With these features, BondSmartly helps investors optimize their portfolios with precision and ease.

Reviews

Reviews

| Item | Votes | Upvote |

|---|---|---|

| No pros yet, would you like to add one? | ||

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

| Item | Votes | Upvote |

|---|---|---|

| Prices for over 500.000 bonds | 1 | |

| Bonds screener | 1 | |

| Reference data for bonds of all types | 1 | |

| Yield curves for all bonds by one issuer. | 1 |

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

Frequently Asked Questions

Dynamiq focuses on building and deploying generative AI applications, which can enhance productivity and streamline workflows, making it suitable for organizations looking to automate tasks and improve decision-making processes. In contrast, BondSmartly is specifically designed for bond investment decisions, offering access to yield curves and comprehensive search filters for over 500,000 bonds. If your primary goal is to optimize bond investments, BondSmartly would be the better choice, while Dynamiq is more suited for broader AI application development.

While Dynamiq provides tools for building AI applications that can automate various tasks, it does not specifically cater to financial analysis or bond investment like BondSmartly does. BondSmartly offers specialized features such as yield curves, bond screening, and yield to maturity calculators, which are essential for making informed bond investment decisions. Therefore, for targeted financial analysis, BondSmartly is the more appropriate platform.

BondSmartly provides access to yield curves for over 500,000 bonds and offers a powerful bond screener with various search filters, making it a comprehensive resource for bond data. Dynamiq, on the other hand, does not focus on bond data but rather on generative AI applications and workflows. Therefore, for comprehensive bond data, BondSmartly is the superior choice.

Dynamiq is an operating platform designed for building, deploying, monitoring, and fine-tuning generative AI applications. It offers a variety of features including low-code workflow automation, custom knowledge base creation, LLM agent operations, observability, guardrails for reliable outputs, and fine-tuning of proprietary LLM models.

The key features of Dynamiq include: - Workflows: Build GenAI workflows in a low-code interface to automate tasks at scale. - Knowledge & RAG: Create custom RAG knowledge bases and deploy vector DBs in minutes. - Agents Ops: Create custom LLM agents to solve complex tasks and connect them to your internal APIs. - Observability: Log all interactions and use large-scale LLM quality evaluations. - Guardrails: Ensure precise and reliable LLM outputs with pre-built validators, detection of sensitive content, and data leak prevention. - Fine-tuning: Fine-tune proprietary LLM models to make them your own.

The benefits of using Dynamiq include: - Air-gapped Solution: Enables clients managing highly sensitive data to leverage LLMs while maintaining stringent security controls. - Vendor-Agnostic: Allows clients to build GenAI applications using a variety of models from different providers and switch between them if needed. - All-In-One Solution: Covers the entire GenAI development process from ideation to deployment.

The use cases for Dynamiq include: - AI Assistants: Equip teams with custom AI assistants to streamline tasks, enhance information access, and boost productivity. - Knowledge Base: Build a dynamic AI knowledge base to streamline decision-making and enhance productivity by reducing the time spent navigating through extensive company documents, files, and databases. - Workflow Automations: Design powerful, no-code workflows to enhance content creation, CRM enrichment, and customer support.

As of now, there are no user-generated pros and cons for Dynamiq. However, its key benefits include stringent security measures, vendor-agnostic integration capabilities, and an all-in-one solution for GenAI development.

BondSmartly.com is a platform designed to streamline bond investment decisions by offering access to yield curves of over 500,000 bonds. It provides users with comprehensive search filters, allowing them to discover using a powerful bonds screener based on various parameters such as ISIN, issuer, coupon rate, and maturity date. Investors can utilize the yield curve data to analyze different bonds and make informed choices. Additionally, the platform features tools like a YTM (Yield to Maturity) calculator and bond screener, making it an all-in-one resource for bond market insights and analytics.

Pros of BondSmartly include prices for over 500,000 bonds, a powerful bonds screener, reference data for bonds of all types, and yield curves for all bonds by one issuer. There are no user-generated cons at this time.

BondSmartly offers several features including a powerful bonds screener based on parameters such as ISIN, issuer, coupon rate, and maturity date. It also provides yield curves for over 500,000 bonds, reference data for bonds of all types, and tools like a YTM (Yield to Maturity) calculator.

BondSmartly helps investors by providing comprehensive tools and data to make informed bond investment decisions. Users can access yield curves for over 500,000 bonds, use a powerful bonds screener to filter based on various parameters, and utilize tools like the YTM calculator to analyze different bonds. This enables investors to optimize their portfolios with precision and ease.

Related Content & Alternatives

- 0

31.Rupert AI

31.Rupert AIRupert AI envisions a world where marketing is not just about reaching audiences but engaging them in the most personalized and effective way. Our AI-driven solutions are designed to make this vision a reality for businesses of all sizes. Key Features - AI model training: You can train your vision model, an object, style or a character. - AI workflows: Multiple AI workflows for marketing and creative material creation. Benefits of AI Model Training - Custom Solutions: Train models to recognize specific objects, styles, or characters that match your needs. - Higher Accuracy: Get better results tailored to your unique requirements. - Versatility: Useful for different industries like design, marketing, and gaming. - Faster Prototyping: Quickly test new ideas and concepts. - Brand Differentiation: Build unique visual styles and assets that stand out. Benefits of AI Workflows - Time Saver: Automates repetitive tasks, speeding up content creation. - Consistency: Keep the look and feel of your brand uniform across different materials. - Cost Effective: Cuts down on manual work, saving resources. - Personalized Content: Easily create variations for different audiences. - Adaptable: Automatically adjusts content for different platforms and formats. Use Case E-Commerce Catalog Expansion: Automatically generate high-quality product images for new items based on a few reference photos. This allows e-commerce businesses to quickly populate their product catalogs without the need for costly photo shoots.

- 0

36.Decopy AI

36.Decopy AIDecopy AI offers a comprehensive platform for detecting AI-generated content in both text and images, as well as verifying the origins of visuals. Key Features 1. AI Content Detector: Identifies whether text is written by AI or humans. 2. AI Image Detector: Detects AI-manipulated images. 3. Reverse Image Search: Finds the original source of an image across the web. Benefits - All of Decopy AI’s powerful detection tools are completely free to use. No subscriptions, no hidden fees—everyone can access and benefit from our AI Content Detector, AI Image Detector, and other tools at zero cost. - AI Detector tools are built on advanced algorithms that provide exceptional accuracy in identifying AI-generated content and images. Whether you’re analyzing text or visuals, Decopy AI delivers reliable results that you can trust. Use Case - Educators verify student submissions for AI-generated work. - Businesses check content authenticity for marketing. - Researchers trace image origins for verification. - Content creators prevent unauthorized use of their visuals.

- 0

46.Refinder AI

46.Refinder AIRefinder is an AI-powered search and assistant solution designed to empower companies and professionals. By seamlessly connecting personal and company applications, Refinder provides a unified search interface that uncovers data you didn’t even know was there. Leveraging advanced AI and Retrieval-Augmented Generation (RAG) technology, Refinder searches across your organization and deep within your content to deliver critical knowledge precisely when your employees need it. Refinder includes pre-built integrations for essential tools like Confluence, Jira, Notion, Google Drive, and Gmail, making it easy to implement and ready to use right out of the box. With Refinder, you’ll quickly and accurately find the information you need, enabling your team to make better-informed decisions in strategic planning and customer interactions. How can Refinder help you? - Optimize HR operations with AI-powered insights, centralizing essential employee information, performance reviews, and onboarding materials in one platform. - Equip your sales and marketing teams with real-time insights into customer needs, fostering more impactful engagement and customer connections. - Enhance your customer service with AI-driven insights that help agents resolve issues faster with relevant, real-time solutions. - Streamline processes from troubleshooting to product development, reducing bottlenecks and enabling quicker, data-driven decision-making. Refinder offers flexible plans to fit teams of any size—from startups to large enterprises—allowing you to scale seamlessly as your needs grow. Transform your company’s data into powerful insights with Refinder—your AI search engine and assistant for the modern enterprise.

- 0

47.NowKnow

47.NowKnowNowKnow helps you get market research done in hours instead of weeks. Ask questions, upload designs, and get thoughtful feedback from AI personas that represent your target audience. Key Features - Fast Results: Get detailed feedback within hours instead of waiting weeks for traditional surveys - Realistic Feedback: AI personas provide authentic responses based on real demographic profiles - Visual Testing: Upload images and designs to get feedback on everything from logos to interfaces - No Privacy Concerns: Since responses come from AI personas, there's no GDPR/CCPA compliance needed Benefits - Test More Ideas: Run multiple studies quickly and affordably - Iterate Freely: Adjust your questions and run new versions instantly - Target Precisely: Get feedback from specific demographic groups - Move Faster: Make informed decisions without long research delays Use Case Test everything from marketing messages to visual designs. Perfect for comparing UI layouts, A/B testing ads, getting feedback on logos, evaluating product mockups, and choosing the best social media content.

- 0

50.Lisapet.ai

50.Lisapet.aiLisapet.ai is the next-level AI product development platform that empowers teams to prototype, test, and ship robust AI features 10x faster. Key Features - Best-in-class AI Playground: Swiftly test and iterate your prompts. Reduce the hassle of prompt prototyping. Our best-in-class AI playground makes the workflow faster, saving you time and effort in designing prompts. - Test-driven prompt engineering: Evalute and measure quality across large data sets. Build a collection of test cases to find the best prompt/model combination across different scenarios Benefits - Save Time: Cut down manual testing and free up your team to focus on shipping features. - Increase Confidence: Automate your testing to ensure reliable AI behavior before deployment. - Optimize Performance: Easily identify the best-performing prompts through side-by-side testing and real-time analytics. - Collaborate Seamlessly: Share progress with stakeholders and incorporate feedback directly within the platform. - Reduce Costs: Monitor token usage and optimize spending with detailed cost breakdowns. Use Case - Rapid Development of AI-Powered Features: Equip your product teams with tools to build, test, and launch AI-powered features without bottlenecks. - Scalable Prompt Engineering: Automate testing and validation to save time and reduce errors in prompt design. - Collaborative Testing: Enable cross-team collaboration by sharing reports and integrating feedback seamlessly.

- 0

53.RabbitHoles AI

53.RabbitHoles AIRabbitHoles AI is an app to have AI conversations on an Infinite canvas. Each node on the canvas is a conversation. Multiple conversations can be connected to share context, along with adding other data sources like Pdf files, youtube videos, etc Key Features - Multiple Chats On Canvas: Have multiple connected chats with AI on the same canvas. - Unlimited Canvases: Create unlimited canvases - Latest Pro Models: Chat with all the popular LLM models from ChatGPT, Claude, Perplexity, Gemini, and Grok (xAI) - Bring Your Own Keys: Bring your own keys. Everything is stored locally - One-Time Purchase: Pay only once and use the product forever Benefits - No loss of context: As a side effect of branching chats, you control the length of the conversation; this prevents loss of context - Spatial Conversation: Learn/research faster on a whiteboard like canvas - Non-linear chats: Our brains don't think or learn linearly, so why should our chatbots be linear? - Multiple LLMs: Get different perspectives from multiple LLM models - Single Window: For every rabbit hole you go into, you stick to one infinite whiteboard that allows you to go deep into intellectual exploration Use Case Advanced AI Users can get what they want out of AI by having long explorative conversations with different AI models on an infinite canvas. There'll be less repetition, copy/pasting, and loss of context as you can: 1. Create branches of the conversations 2. Keep multiple conversations on a single canvas 3. Mix and match various chats to share context

- 012.Cakewalk AI

Awesome tool that helps organize your AI work with workspaces and dynamic prompts. This lets you build prompts using {{variables}}!.

- 0

19.StartKit.AI

19.StartKit.AIStartKit.AI is a boilerplate designed to speed up the development of AI projects. It offers pre-built REST API routes for all common AI tasks: chat, images, long-form text, speech-to-text, text-to-speech, translations, and moderation. As well as more complex integrations, such as RAG, web-crawling, vector embeddings, and much more! It also comes with user management and API limit management features, along with fully detailed documentation covering all the provided code. Upon purchase, customers receive access to the complete StartKit.AI GitHub repository where they can download, customize, and receive updates on the full code base. 6 demo apps are included in the code base, providing examples on how to create your own ChatGPT clone, PDF analysis tool, blog-post creator, and more. The ideal starting off point for building your own app!

- 0

25.Lightning AI

25.Lightning AILightning AI is the company behind PyTorch Lightning, the deep learning framework for training, finetuning and serving AI models (80+ million downloads). PyTorch Lightning started in 2015 by Lightning founder William Falcon while working on computational neuroscience research at Columbia University scaling Generative Adversarial Networks and Autoencoders in the context of neural decoding working under Liam Paninski. He open sourced it in 2019 while pursuing a PhD in self-supervised learning (SSL) at NYU and Facebook AI Research (FAIR) supervised by Kyunghyun Cho and Yann Lecun. SSL techniques are at the heart of models like Chat GPT (next word prediction). In 2019 PyTorch Lightning started to be used to train huge models on 1024+ GPUs inside Facebook AI. Today, it’s used by over 10,000 companies and 1+ million developers to train, finetune and deploy the world’s largest models. Lightning AI started in 2020 as a platform to train models on the cloud across 1000s of GPUs. Today, the platform has evolved to a fully end-to-end platform covering everything from distributed data processing, training, finetuning foundation models, to serving and deploying AI apps. Lightning Studios expand on PyTorch Lightning’s core ethos of “You do the science, we do the engineering” by delivering the world’s most intuitive, easy to use, fastest platform for working on AI. From prototyping research ideas to deploying foundation models.

- 0

34.ContentStudio AI

34.ContentStudio AITransform Your Ideas into Automated Videos with AI

- 0

38.Narrow AI

38.Narrow AIIntroducing Narrow AI: Take the Engineer out of Prompt Engineering Narrow AI autonomously writes, monitors, and optimizes prompts for any model - so you can ship AI features 10x faster at a fraction of the cost. Maximize quality while minimizing costs - Reduce AI spend by 95% with cheaper models - Improve accuracy through Automated Prompt Optimization - Achieve faster responses with lower latency models Test new models in minutes, not weeks - Easily compare prompt performance across LLMs - Get cost and latency benchmarks for each model - Deploy on the optimal model for your use case Ship LLM features 10x faster - Automatically generate expert-level prompts - Adapt prompts to new models as they are released - Optimize prompts for quality, cost and speed Learn more at getnarrow.ai

- 0

46.Pixvify AI

46.Pixvify AIPixvify is the top free realistic AI photo generator platform, helping create images, do face swaps, etc. Core Features of Pixvify: 1. AI Photo Generation: Create high-quality, realistic images instantly. Create unique images with advanced AI technology. 2. Face Swapping: Seamlessly swap faces in photos with precision. 3. Image Editing: Powerful tools for enhancing images, including cropping, color adjustments, and adding effects. User cases: Pixvify is built on advanced AI algorithms and powerful computing capabilities to easily and consistently generate high-quality, realistic art. Combined with other free AI tools, it takes your workflow to the next level. 1. Social Media Content: Enhance your posts with unique AI-generated images and fun face swaps. 2. Creative Projects: Save time on image creation for digital art, design, and marketing campaigns.

- 0

48.DreamjourneyAI

48.DreamjourneyAIDreamjourneyAI is a no filter ai roleplay platform that allows people to dive into their fantasies with the help of generative ai. They can engage in AI character chats, roleplay s and infinite text rpgs on this platform.

- 0

3.There's an AI

3.There's an AIThese days, AI directories are popping up all over the place. You’ve got huge lists—like that GitHub one —best-of-ai/ai-directories—and tons of sites trying to round up every AI tool under the sun. It’s a lot, right? Problem is, most of them are packed with meh tools. You dig through glitchy apps or overhyped stuff that doesn’t even work, and it’s a total time suck. Marketers like us? We don’t have time for that—we need tools that actually deliver. That’s where There’s an AI comes in. It’s not like those other messy directories. This one’s all about the good stuff—think of it like a stash of hidden gems, no junk allowed. You can navigate easily on different categories in it, jumping from content tools to ad optimizers without breaking a sweat. And the search? Oh, it’s clutch. You can type in whatever you want, and it pulls up only the best—no shitty tools clogging up your screen.

- 0

3.Yimeta AI - AI Tools Website Builder Platform

3.Yimeta AI - AI Tools Website Builder PlatformYiMeta is a platform for building AI tool websites, designed to help users effortlessly create and customize various AI-powered tools. The key features include: ● One-Click Website Creation: With no coding skills required, YiMeta uses AI to generate SEO-optimized web pages that are ready to use. Users can further edit the content to enhance website conversion rates. ● Rich Collection of AI Tools: YiMeta offers over 100 versatile AI tools and supports unique workflow editing, integrated with ComfyUI workflows. Whether for text, image, or video-related tools, users can create them instantly. ● Professional SEO Structure Management: Leveraging extensive experience in content creation for tools, YiMeta applies advanced SEO expertise to ensure the success of users’ tool websites. ● Convenient Financial Management: YiMeta provides comprehensive analytics for traffic and financial data, enabling users to focus on business growth and keyword optimization. YiMeta offers a free online AI face swap tool. Users can upload photos and perform face swaps without registration.

- 0

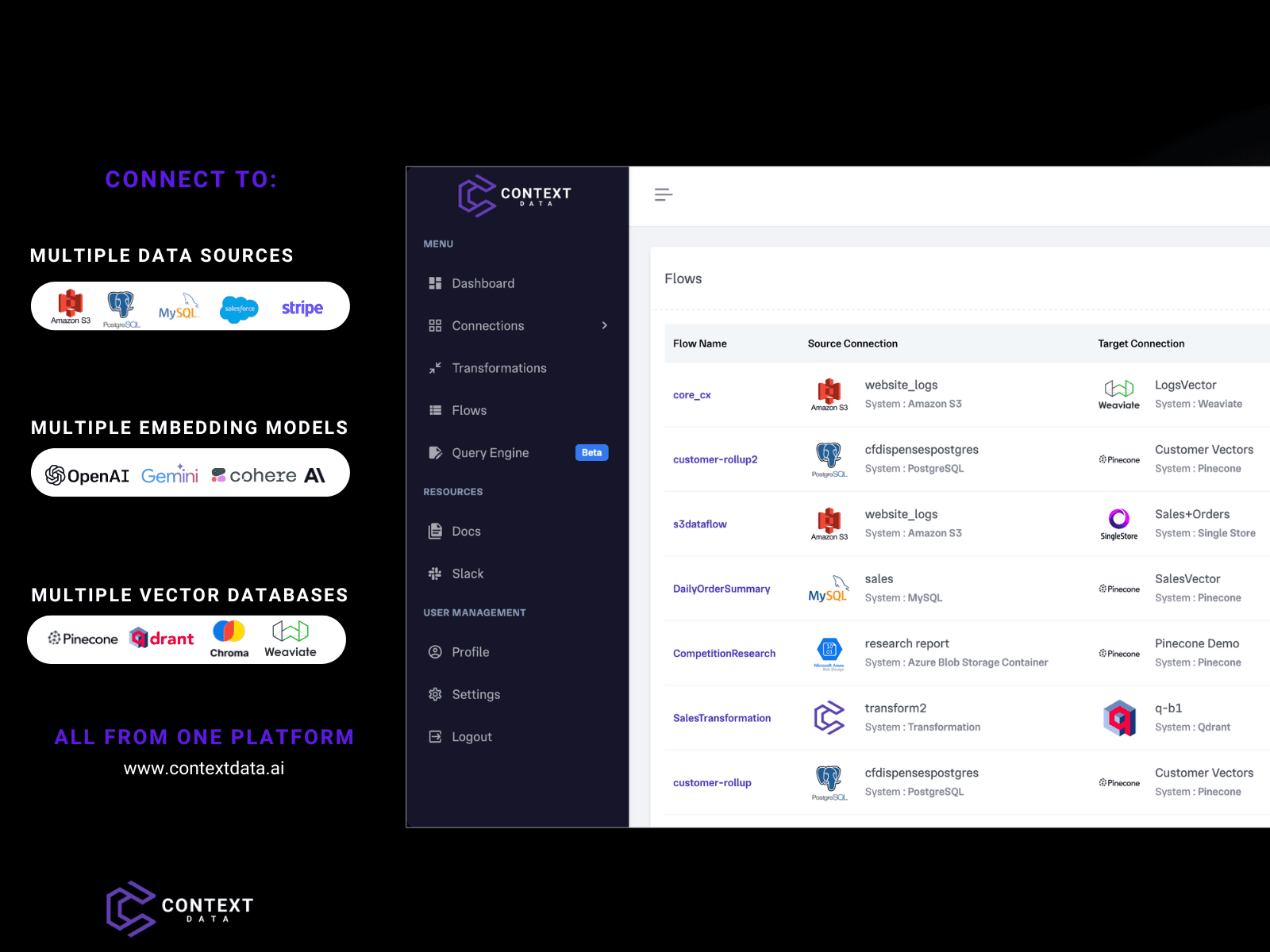

2.Context Data

2.Context DataContext Data is an enterprise data infrastructure built to accelerate the development of data pipelines for Generative AI applications. The platform automates the process of setting up internal data processing and transformation flows using an easy-to-use connectivity framework where developers and enterprises can quickly connect to all of their internal data sources, embedding models and vector database targets without having to set up expensive infrastructure or engineers.

- 1

1.Owlbot

1.OwlbotOwlbot offers a cutting-edge AI-powered chatbot service that seamlessly integrates with your data to provide instant responses for you, your customers, or your team. Deploying a tailor-made AI chatbot with Owlbot is straightforward, enhancing both customer service and the efficiency of data analysis with minimal effort. Our AI chatbot is capable of handling 90% of inquiries from customers, clients, or employees effortlessly (>90 languages supported). It can import data from a variety of sources, including documents, markdown files, and webpages, ensuring that you receive precise, immediate answers. Additionally, you can connect the chatbot to your internal tools to access private data in real-time and provide timely responses. You can choose from 12 different large language models (LLMs), such as Mistral, OpenAI, and Anthropic, to find the option that best fits your needs. Owlbot also captures the details of interested visitors, helping you compile a list of potential leads and expand your business opportunities.

- 0

22.AI Tools

22.AI ToolsAI Tools is a directory of all AI-driven products. It features AI assitants, SEO AIs, eCommerce AIs, programming AIs and many more. It's easy to submit your tools and it's free to use.

- 0

32.AIChief

32.AIChiefAIChief is the largest and fastest digital platform providing valuable insights into AI tools, their reviews, potential guides, personal opinions, insightful journals, and daily updates about the latest AI trends and usage. Our easy-to-understand guides intertwine artificial intelligence with humans and make it easier to understand how AI is transforming the ways of our lives.

- 0

35.NewAIForYou

35.NewAIForYouYour Guide to the Newest AI Products, Updated daily. Explore top AI tools updated daily at NewAIForYou.com. Our curated directory offers the latest in AI with expert insights.