Context Data vs. BondSmartly

Context Data

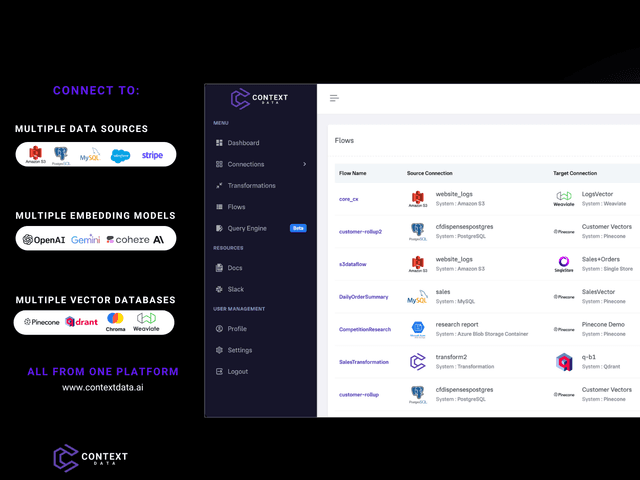

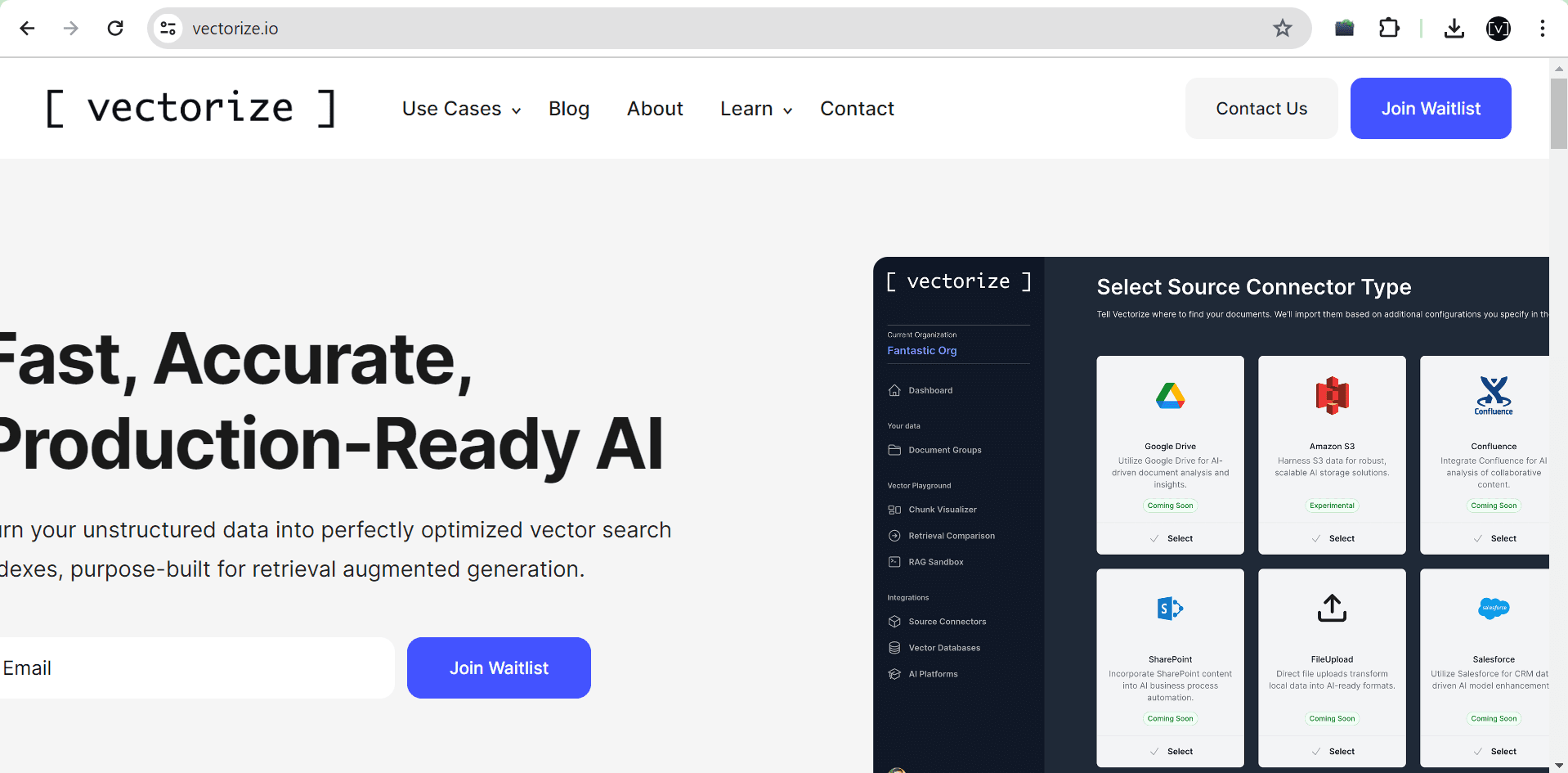

Context Data is an enterprise data infrastructure built to accelerate the development of data pipelines for Generative AI applications. The platform automates the process of setting up internal data processing and transformation flows using an easy-to-use connectivity framework where developers and enterprises can quickly connect to all of their internal data sources, embedding models and vector database targets without having to set up expensive infrastructure or engineers.

BondSmartly

BondSmartly.com is a platform designed to streamline bond investment decisions by offering access to yield curves of over 500,000 bonds. It provides users with comprehensive search filters, allowing them to discover using a powerful bonds screener based on various parameters such as ISIN, issuer, coupon rate, and maturity date. Investors can utilize the yield curve data to analyze different bonds and make informed choices. Additionally, the platform features tools like a YTM (Yield to Maturity) calculator and bond screener, making it an all-in-one resource for bond market insights and analytics. With these features, BondSmartly helps investors optimize their portfolios with precision and ease.

Reviews

Reviewed on 6/19/2024

Context Data is a Data Processing & ETL infrastructure for Generative AI applications. --- For startups and enterprise companies that are building internal Generative AI solutions, Context Data automates the process and time to deploy data platforms from an average of 2 weeks to less than 10 minutes and at 1/10th of the cost.

Reviews

| Item | Votes | Upvote |

|---|---|---|

| Multi-Source Transformations | 1 | |

| One-Click Model Connections | 1 | |

| Smart Scheduling | 1 |

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

| Item | Votes | Upvote |

|---|---|---|

| Prices for over 500.000 bonds | 1 | |

| Bonds screener | 1 | |

| Reference data for bonds of all types | 1 | |

| Yield curves for all bonds by one issuer. | 1 |

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

Frequently Asked Questions

Context Data is specifically designed to accelerate the development of data pipelines for Generative AI applications, automating data processing and transformation flows. It is ideal for startups and enterprises focused on AI solutions. In contrast, BondSmartly is tailored for bond investment decisions, providing extensive yield curve data and screening tools for over 500,000 bonds. Therefore, the suitability depends on whether the focus is on AI data infrastructure or bond investment analytics.

Context Data excels in data connectivity features, offering multi-source transformations and one-click model connections, which streamline the integration of various internal data sources for Generative AI applications. BondSmartly, while providing comprehensive bond data and screening capabilities, does not focus on data connectivity in the same way. Thus, for data connectivity, Context Data is the superior choice.

BondSmartly is primarily focused on bond investment insights and does not cater to Generative AI applications. It offers tools for analyzing bonds and optimizing investment portfolios, while Context Data is built to support the development of data pipelines specifically for AI. Therefore, BondSmartly cannot provide the same insights for Generative AI as Context Data.

Context Data is designed to significantly reduce the time and cost of deploying data platforms for Generative AI, with claims of reducing deployment time from weeks to minutes and costs to a fraction of traditional methods. BondSmartly does not focus on deployment costs but rather on providing bond investment tools. Therefore, for cost-effective data solution deployment, Context Data is the better option.

Context Data is an enterprise data infrastructure designed to accelerate the development of data pipelines for Generative AI applications. It automates the setup of internal data processing and transformation flows using an easy-to-use connectivity framework. This allows developers and enterprises to quickly connect to all of their internal data sources, embedding models and vector database targets without the need for expensive infrastructure or engineers.

Pros of Context Data include Multi-Source Transformations, One-Click Model Connections, and Smart Scheduling. Currently, there are no user-generated cons listed for Context Data.

Context Data automates the process and time to deploy data platforms for startups and enterprise companies building internal Generative AI solutions. It reduces the deployment time from an average of 2 weeks to less than 10 minutes and cuts the cost to 1/10th of the traditional expense.

Context Data provides a Data Processing & ETL infrastructure specifically designed for Generative AI applications.

BondSmartly.com is a platform designed to streamline bond investment decisions by offering access to yield curves of over 500,000 bonds. It provides users with comprehensive search filters, allowing them to discover using a powerful bonds screener based on various parameters such as ISIN, issuer, coupon rate, and maturity date. Investors can utilize the yield curve data to analyze different bonds and make informed choices. Additionally, the platform features tools like a YTM (Yield to Maturity) calculator and bond screener, making it an all-in-one resource for bond market insights and analytics.

Pros of BondSmartly include prices for over 500,000 bonds, a powerful bonds screener, reference data for bonds of all types, and yield curves for all bonds by one issuer. There are no user-generated cons at this time.

BondSmartly offers several features including a powerful bonds screener based on parameters such as ISIN, issuer, coupon rate, and maturity date. It also provides yield curves for over 500,000 bonds, reference data for bonds of all types, and tools like a YTM (Yield to Maturity) calculator.

BondSmartly helps investors by providing comprehensive tools and data to make informed bond investment decisions. Users can access yield curves for over 500,000 bonds, use a powerful bonds screener to filter based on various parameters, and utilize tools like the YTM calculator to analyze different bonds. This enables investors to optimize their portfolios with precision and ease.