Ambriel

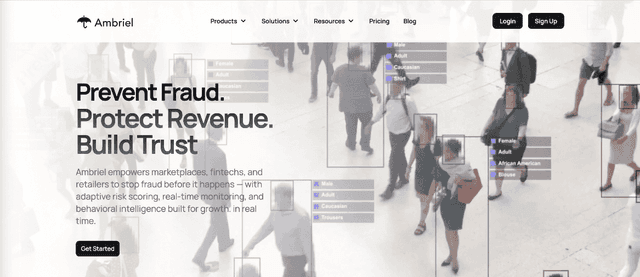

Ambriel is an advanced fraud intelligence and risk management platform built to help digital businesses operate securely, comply with regulations, and protect their users — without adding friction to legitimate activity. Designed for fintech, marketplaces, retailers, and iGaming platforms, Ambriel combines behavioral analytics, device intelligence, sanctions screening, and real-time risk scoring into one powerful ecosystem. At its core, Ambriel enables organizations to detect, score, and prevent fraud before it impacts revenue or reputation. It analyzes transactions, user behaviors, devices, and network signals to uncover hidden risk patterns and automate mitigation. With Ambriel, you can identify suspicious activity such as multi-accounting, bonus abuse, referral fraud, synthetic identity creation, payment fraud, and money laundering — all in real time.

Reviews

| Item | Votes | Upvote |

|---|---|---|

| No pros yet, would you like to add one? | ||

| Item | Votes | Upvote |

|---|---|---|

| No cons yet, would you like to add one? | ||

Ambriel is an advanced fraud intelligence and risk management platform designed to help digital businesses operate securely, comply with regulations, and protect their users without adding friction to legitimate activity. It is particularly tailored for fintech, marketplaces, retailers, and iGaming platforms.

Ambriel helps in fraud prevention by combining behavioral analytics, device intelligence, sanctions screening, and real-time risk scoring. It analyzes transactions, user behaviors, devices, and network signals to detect, score, and prevent fraud before it impacts revenue or reputation.

Ambriel can detect various types of fraud including multi-accounting, bonus abuse, referral fraud, synthetic identity creation, payment fraud, and money laundering, all in real time.

Organizations in sectors such as fintech, marketplaces, retail, and iGaming can benefit from using Ambriel, as it provides a comprehensive solution for managing fraud risk and ensuring compliance.

The main features of Ambriel include behavioral analytics, device intelligence, sanctions screening, real-time risk scoring, and automated fraud mitigation, all integrated into a powerful ecosystem.